EV Supply Chain in India – The Beginning

Global demand for EVs is increasing; According to estimates, the market opportunity for electric cars in India is valued at around USD 206 billion by 2030. Despite accounting for less than 1% of total car sales in the country, electric vehicle sales are increasing, with over 50,000 new registrations each month. This gives rise to the EV supply chain in India.

EV Industry in India – Current Scenario

With 100% FDI allowed, new production centers and an enhanced drive to improve charging infrastructure, India’s electric car sector is picking up speed. Other development factors for the Indian EV sector include government subsidies and policies supporting larger discounts for Indian-made electric two-wheelers, as well as a boost for localized ACC battery storage manufacture. Furthermore, in September 2021, Cabinet authorized a production-linked incentive plan for the automotive sector to stimulate the manufacture of electric vehicles and hydrogen fuel cell vehicles. In 2021, India announced sales of over 3 Lac EV vehicles.

The Indian automobile sector is the fifth largest in the world, with a goal of being the third-largest by 2030. Relying on traditional means of fuel-intensive mobility to serve a large domestic market will not be sustainable. To solve this, government authorities are proposing a mobility choice that is “Shared, Connected, and Electric,” with the goal of reaching 100% electrification by 2030.

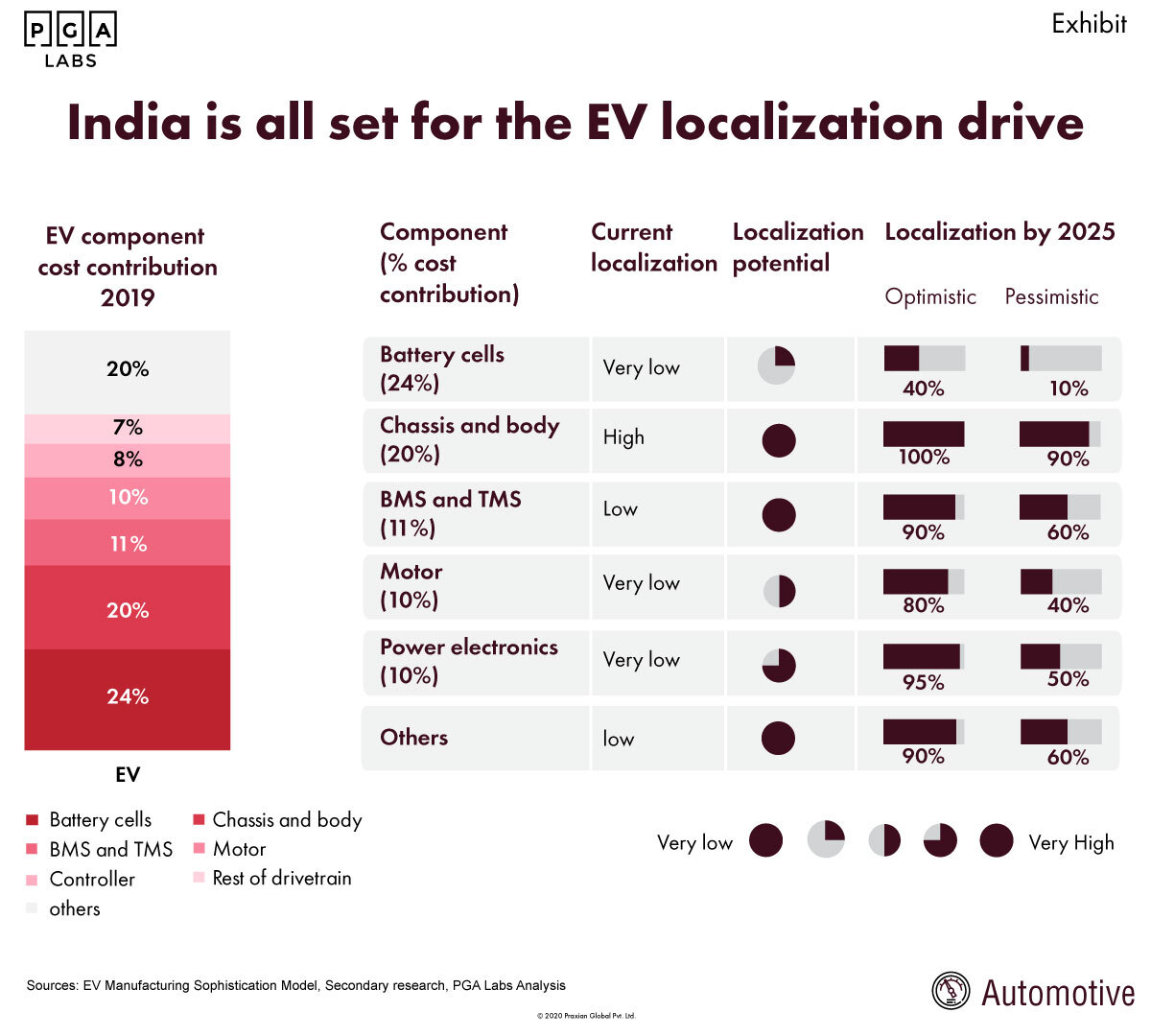

Localization of EV Manufacturing in India

With its INR 10K Cr FAME – Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles Scheme, the Indian government has given EVs a boost. Large-scale investments have already been planned by M&M, Maruti, Tata Motors, Hero Electric, Toyota, and others, with governmental support through E-mobility manufacturing incentives to industry and purchase incentives to users through new EV policies of at least 10 State Governments, FAME I & FAME II, PLI schemes, scrappage policy, enhancement of e charging infrastructure, and reduction of GST on purchase of EVs.

EVs were subjected to extra constraints under the FAME-II scheme to be eligible for subsidies. OEMs must now ensure that buses have at least 40% localization (at ex-factory prices) and other categories have at least 50% localization. Benefits for lead-acid batteries were phased out in favor of Li-ion batteries. Import tariffs on Completely Built Units (CBUs), Semi Knocked Downs (SKDs), and Completely Knocked Downs (CKDs) have also been increased by 5% to 25%, effective April 2020. Duty rates for Li-ion cells and battery packs, on the other hand, are expected to rise from 5% to 10% and 15%, respectively. Before moving to a high tax regime on Li-ion cells, it would be sensible to provide large-scale incentives for the development of Giga factories in India, so that India can establish the requisite ecosystem to manufacture them.

EV Supply Chain Management

A few modifications to the automotive supply chain will not be enough to accelerate the transition to electrified vehicles. It will need a lot more. Electric automobiles require completely different components than their predecessors, such as busbars, heat sinks, and insulated-gate bipolar transistors. Though traditional automobile components are still in demand, electronics account for a major portion of completed electric vehicles, implying that the high commoditization of these parts is the way of the future. As a result, it’s no surprise that the electric car supply chain isn’t nearly as developed as the typical automotive supply chain.

Yes, there are obstacles, but there are also solutions. A strong, supporting supply chain with a validated supplier network can help control risks at the same time. The Indian car market’s thirst for electric vehicles is growing, but the question of the EV supply chain’s reliability persists. The misalignment of demand and supply has the potential to destabilize market sentiment and consumer confidence.

Schemes like Atma Nirbhar Bharat and Make in India encourage supply chain localization, which could help the EV industry reduce its dependency on imports.

Battery Cells, Chassis & Body, Motor, BMS, Power Electronics, and other EV components can be divided into 5–6 groups. Battery cells, motors, and power electronics account for over half of the total EV cost. The fact that the above-mentioned components have the lowest level of localization is a sobering reality. Batteries are still the most significant component of supply chain management, whether it’s for electric two-wheelers or three-wheelers.

Some of the biggest difficulties afflicting the EV supply chain include the lack of lithium, poor R&D and technology intervention, rare earth magnets for motors, and power electronics. As a result, it would be beneficial if the Indian EV supply chain ecosystem took steps such as increased investment in battery research and development. ISRO and DRDO, for example, have recently been conducting groundbreaking research at their laboratories.

Today, a calibrated strategy to resolve supply chain difficulties in the Indian market is required, with the participation of all players.

- Anil Dahari Ram Yadav